-

Meet with the HavenQuest Team

At our initial meeting, you will get to know us at HavenQuest and we will get to know you! We will discuss your needs and wants, inform you about local market conditions and the purchase process, get all of our initial questions answered and then get you ready to see homes in person. -

Pre-Approval

Assuming your purchase will require a loan, we always recommend that our clients get pre-approved as the first step in the purchase process. This is helpful for three reasons: you will confirm you are able to be approved for a loan, you will confirm your price range, and you will be able to quickly demonstrate to a seller that you are qualified to make a purchase. A great lender can make or break a deal, and we can connect you with multiple lenders to choose from who have consistently done a great job on past transactions for our clients. -

Private Showings

We schedule private showings for our clients so that you can see homes on days and at times that are convenient to you. During these showings, you will be able to explore homes at your own pace, and we can provide our unbiased perspective on the homes you can see. We always encourage our clients to see more properties rather than less so that you can have a good sense of what is available, know what your budget gets you in different neighborhoods, and better establish what your priorities are for the home that you end up purchasing. -

Submit Offer

Once you have seen a home you like, we will guide you through the offer and negotiation process. We will submit a TREC (Texas Real Estate Commission) contract, which the seller can either accept, reject, or counter. Once both parties come to an agreement and sign, you are “under contract” to purchase the property. You will then have a set number of days to deliver your earnest money deposit, which is money put down up front as collateral. -

Inspection Period

You will have a period of time to conduct inspections of the property, which vary on each transaction. If items of concern are discovered during this timeframe, you will have the opportunity to request that the seller make repairs, reduce the purchase price, and/or provide a credit toward your closing costs. -

Appraisal

Your lender will likely require an appraisal to be performed to verify the value of the home. Assuming the appraisal comes back at or above the purchase price, and there are no other appraisal conditions, no action will be needed. If the appraisal comes back below the purchase price, either you will need to bring more funds to the closing, the seller will need to drop the price, a combination of both, or you’ll need to terminate the transaction. -

Complete Loan Process

While you are under contract, your loan officer will likely require additional documentation. Once the loan officer receives all required documents and conducts a successful appraisal, they will be able to issue a clearance to close, meaning you are fully approved for the loan and the bank is ready to provide the funds for a successful closing. -

Final Walk-Through

A final walk-through of the property is performed just prior to closing. The walk-through confirms that no damage has been done to the home since the time of inspection, that any repairs that were agreed to were performed, and that the home is otherwise in the same condition as it was at the time you went under contract. -

Closing

Once all the conditions of the contract have been satisfied, the closing is held. At the closing, the closing documents are signed, payment is exchanged, and usually, the buyer receives the keys to their new home at the closing table unless other arrangements have been made for the seller to rent the property back from the buyer for a set period of time. -

After Close

We are always available as a resource for any real estate related questions you may have including filing for your homestead exemption and also protesting your property taxes.

When you are ready to get started, call us at 903.500.2223 or complete this short form and one of our agents will be in touch.

Request A Call

Instructions

1. Enter your information into each required field. Hover the info bubbles for more information.

2. Populating all editable fields with values will increase the accuracy of the results.

3. You may go back at any time to modify the contents of the fields.

4. Click “Calculate” to populate your results immediately.

**Disclaimer: The mortgage calculator provided on this website is for informational purposes only. The results generated by the calculator are based on certain assumptions and should not be considered as financial advice or a guarantee of mortgage qualification or rates. The calculated figures may not reflect the actual costs, fees, or interest rates associated with a mortgage loan. It is important to consult with a qualified mortgage professional and obtain personalized advice based on your specific financial situation and the current market conditions. The use of this calculator does not create a client relationship with the website owner, and we assume no responsibility or liability for any decisions made based on the results obtained from the calculator.

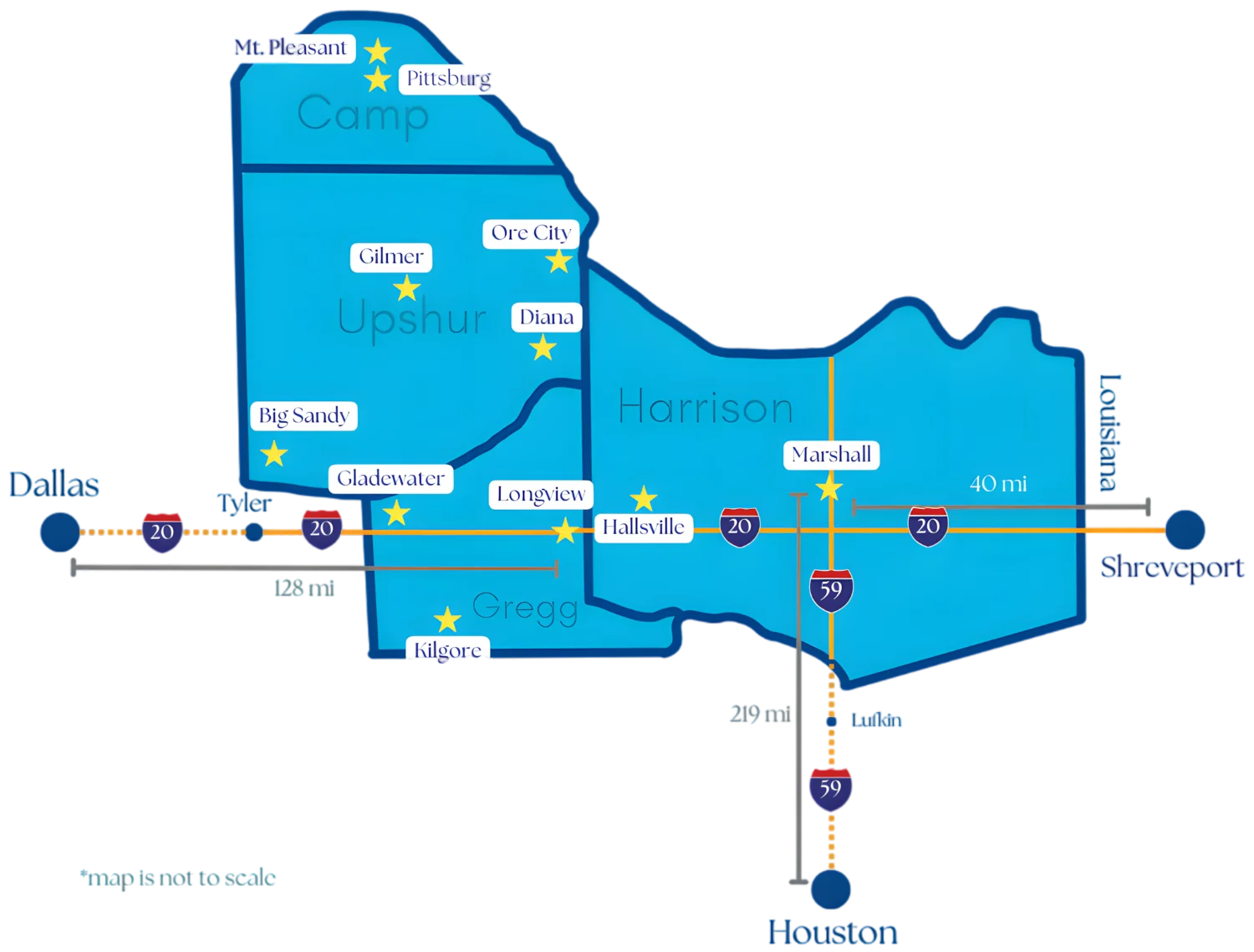

Areas We Serve

- Longview

- Marshall

- Mt. Pleasant

- Pittsburg

- Kilgore

- Hallsville

- Gladewater

- Big Sandy

- Diana

- Gilmer

- Ore City